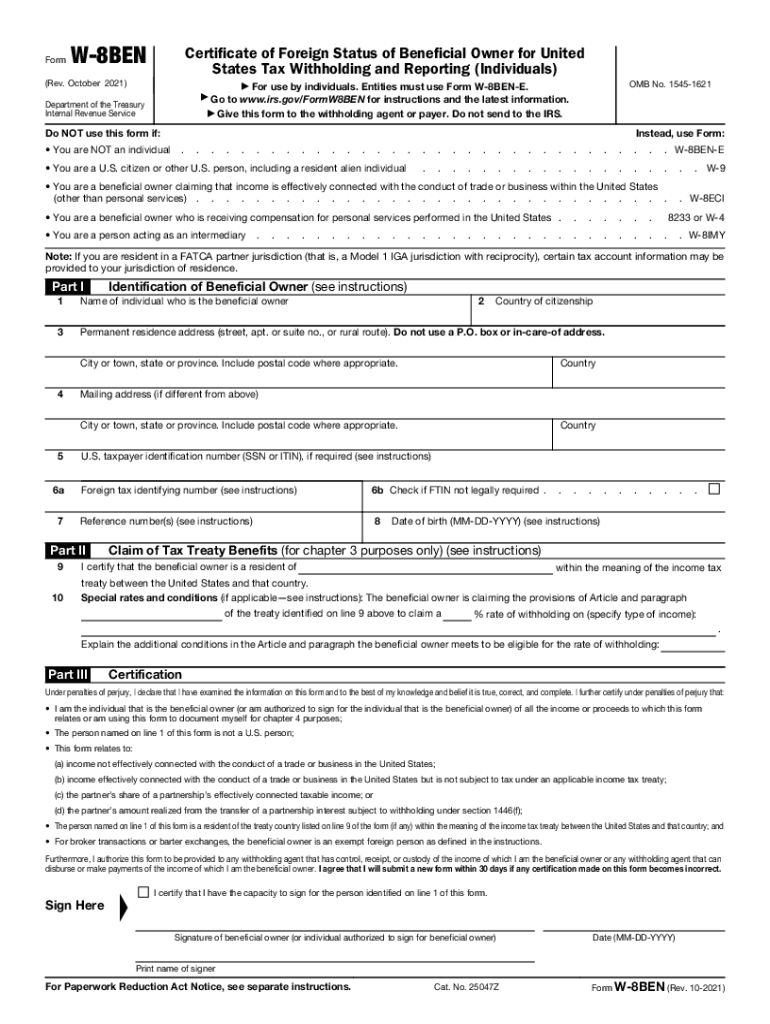

IRS W-8BEN 2021-2026 free printable template

Instructions and Help about IRS W-8BEN

How to edit IRS W-8BEN

How to fill out IRS W-8BEN

Latest updates to IRS W-8BEN

All You Need to Know About IRS W-8BEN

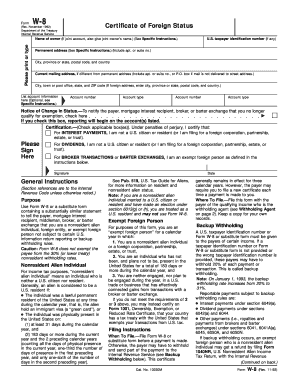

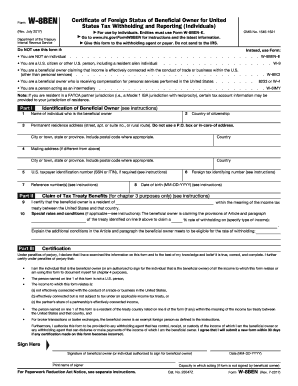

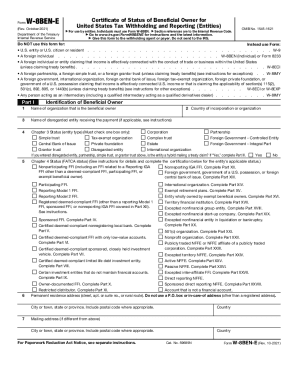

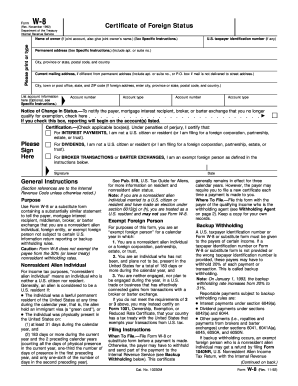

What is IRS W-8BEN?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS W-8BEN

What should I do if I realize I've filled out the IRS W-8BEN incorrectly?

If you discover an error on your IRS W-8BEN after submission, you should prepare and submit a corrected version. Make sure to indicate that this is an amended form and include all correct information to avoid confusion. It's also advisable to notify the relevant payor that you are submitting a correction to ensure accurate processing.

How can I verify if my submitted IRS W-8BEN has been received and processed?

To verify receipt and processing of your IRS W-8BEN, reach out to the payor you submitted the form to, as they should have a record of its receipt. Keep in mind that there may be processing delays, so allow some time before making inquiries. Maintaining communication with the payor helps in addressing any potential issues that arise.

Are there specific legal considerations for nonresidents filing IRS W-8BEN?

Yes, nonresidents should consider the implications of their residency status when filing the IRS W-8BEN. Different countries have tax treaties that may affect the withholding tax rate on payments. It's advisable for nonresidents to consult with a tax professional to ensure compliance with all relevant regulations and possible treaty benefits.

What are some common errors to avoid when completing the IRS W-8BEN?

Common errors when filling out the IRS W-8BEN include omitting required information, using incorrect identifying numbers, and failing to sign the form. Ensure that all sections are completed accurately and verify your identification details against official documents before submission to prevent delays or rejections.

Can I e-file the IRS W-8BEN, and are there any technical requirements?

Yes, you can e-file the IRS W-8BEN, but it is essential to use compatible software that meets IRS requirements, as well as ensure you are using a supported browser. Regular updates to software may be necessary to comply with current online filing standards, so check with your provider for specific technical guidelines.

See what our users say