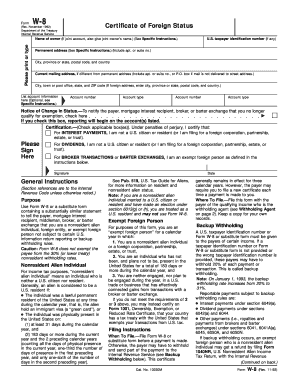

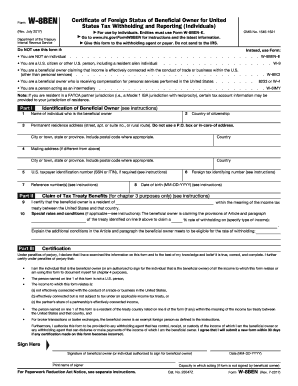

IRS W-8BEN 2021-2025 free printable template

Show details

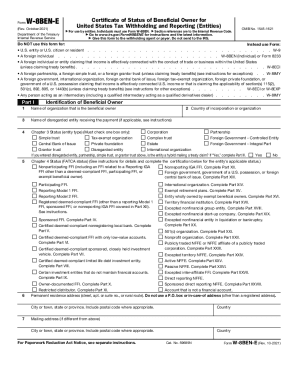

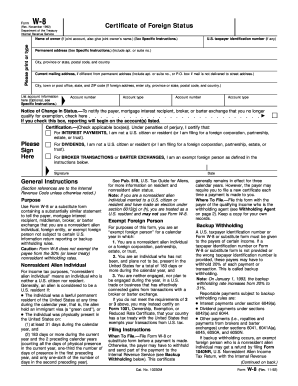

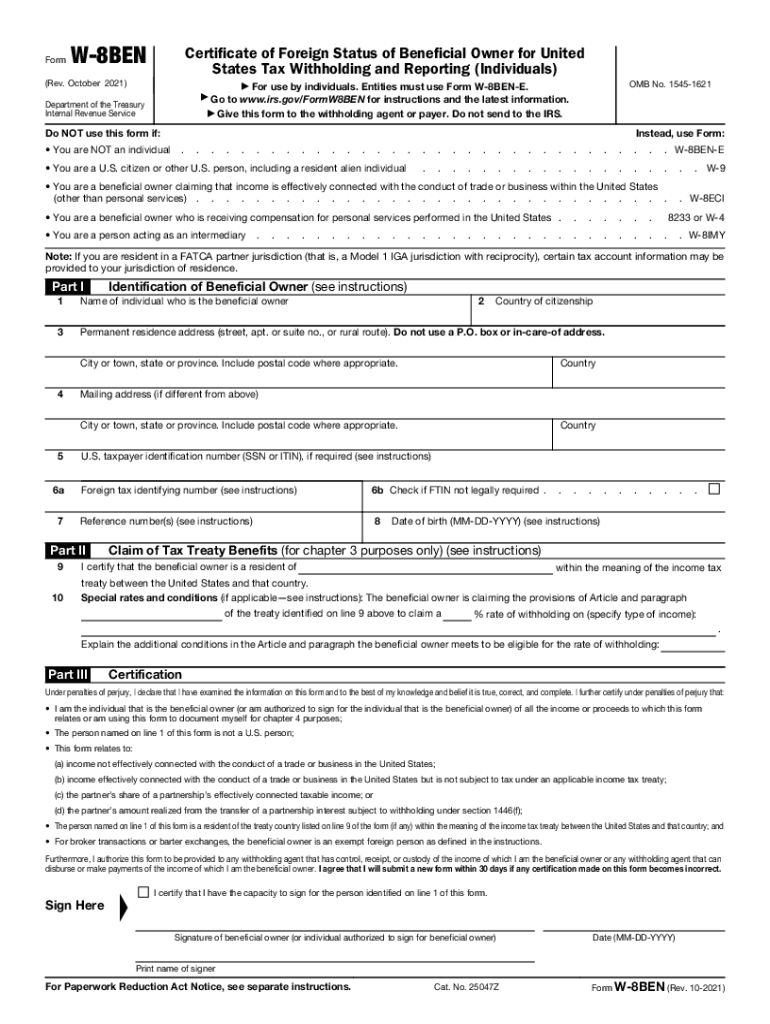

Entities must use Form W-8BEN-E. Go to www.irs.gov/FormW8BEN for instructions and the latest information. Give this form to the withholding agent or payer. W-8BEN-E You are a beneficial owner claiming that income is effectively connected with the conduct of trade or business within the U.S. other than personal services. Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals Rev. July 2017 OMB No. 1545-1621 For use by...

pdfFiller is not affiliated with IRS

W-8BEN form: instructions and help

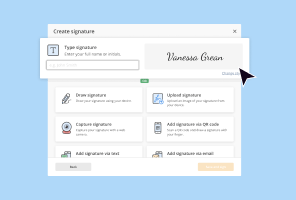

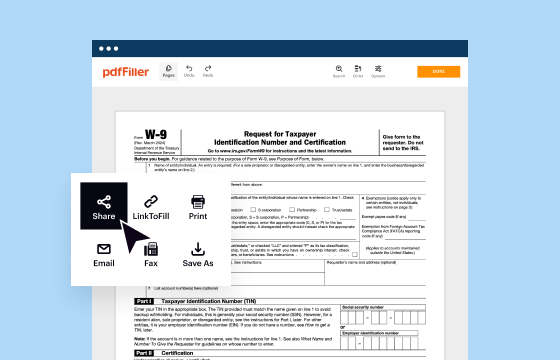

How to edit W-8BEN tax form online with pdfFiller

How to fill out a W-8BEN form online in PDF format

Video instructions and help with filling out and completing W-8BEN form

W-8BEN form: instructions and help

Here you can find the requirements of Form W-8BEN, essential for businesses to ensure accurate and compliant tax information reporting.

How to edit W-8BEN tax form online with pdfFiller

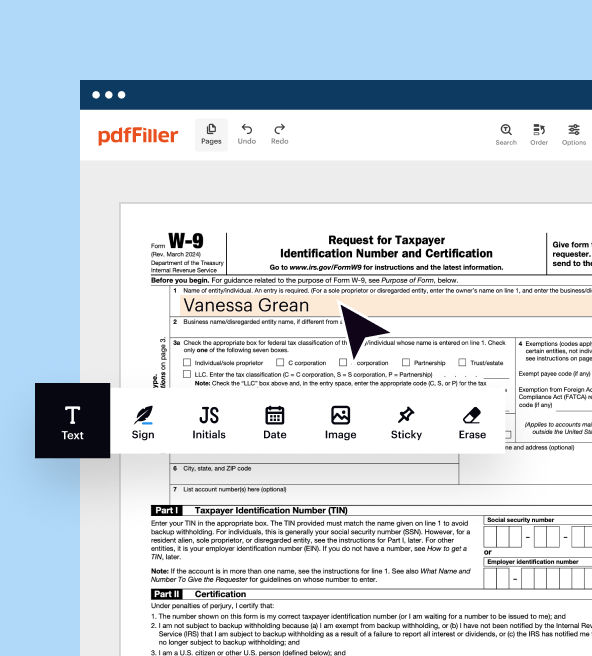

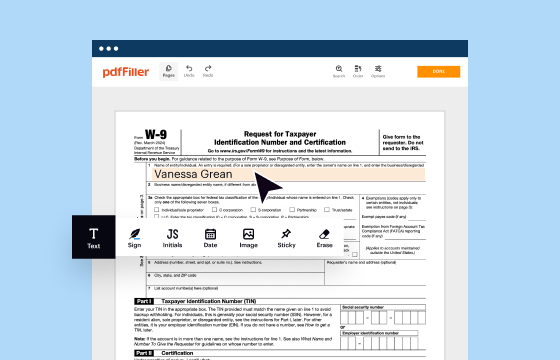

Editing tax forms is effortless with pdfFiller. Here's how you can edit your W-8BEN form online with ease:

01

Start by clicking Get Form at the top to open the W-8BEN form template in the editor.

02

Fill in the necessary fields with the editor tools: add text, numbers, and checkmarks as guided. You can also protect your document with watermarks.

03

Click Done to save your document when the form is completed.

04

Create a pdfFiller account with your email credentials, and sign up for a free 30-day trial

05

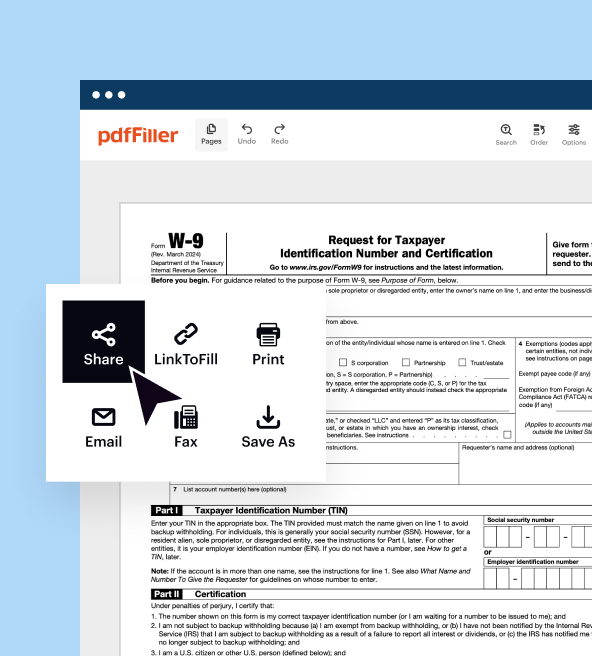

After saving a completed W-8BEN form, download, eSign, or print your completed document.

06

Send your ready electronic version of the document by email.

07

Print and mail your filled W-8BEN, or opt for the Mail by USPS if you prefer a paper copy.

That’s it! Once you experience pdfFiller’s intuitive and straightforward online editing process, it becomes your best way to fill out tax forms.

How to fill out a W-8BEN form online in PDF format

With advances in digital tools, editing and completing W-8BEN form online has become more accessible and efficient. Several platforms allow you to fill out your forms digitally, minimizing errors and streamlining the submission process.

Before completing the template, you must read W-8EN form instructions and prepare all supporting documents, payment checks, and information on the party that provided services during the tax year.

Step 1: Visit the IRS website or a tax form service provider to access the W-8BEN form.

Step 2: Enter personal information.

Step 3: Provide address details.

Step 4: Enter identification numbers.

Step 5: Enter optional reference information.

Step 6: Enter your date of birth in the format MM-DD-YYYY.

Step 7: Claim the Tax Treaty Benefits.

Step 8: Read the certification statement thoroughly to ensure accuracy.

Step 9: Save the completed W-8BEN form as a PDF or in the format your withholding agent requires.

Step 10: Submit the form electronically or as directed by the withholding agent or payer.

You can refer to a completed W-8BEN sample for accuracy and completeness. But if you don’t have one, don’t worry! By following these steps, you will accurately complete Form W-8BEN online, ensuring all necessary information is captured to support your foreign status and any applicable treaty benefits.

Video instructions and help with filling out and completing W-8BEN form

Show more

Show less

Latest Updates to W-8BEN form

Latest Updates to W-8BEN form

W-8BEN tax form was revised in October, 2021. This update made filling out the document easier and more efficient for non-US individuals. Here are the main changes:

01

Guidance Under Section 1446(f): Added through the Tax Cuts and Jobs Act, section 1446(f) requires a 10% withholding on certain partnership transfers by non-U.S. individuals.

02

New Lines 6a and 6b: Line 6a requires a Foreign Tax Identification Number (FTIN) if applicable; line 6b allows exemption from providing an FTIN.

03

Claims of Tax Treaty Benefits: Updated to include requirements for non-U.S. partners claiming treaty benefits under section 864(c)(8).

04

Section 6050Y Reporting: Updates for foreign sellers of life insurance interests and recipients of reportable death benefits.

05

Electronic Signature: Additional guidelines are now included for electronic signatures on Form W-8BEN.

General facts you should know about the W-8BEN tax form

What is W-8BEN form?

Who needs W-8BEN form 2025?

When are W-8BEN forms due to the IRS in 2025?

Is IRS Form W-8BEN accompanied by any other documents?

Where do I send W-8BEN form?

What payments and purchases are reported in the W-8BEN tax form?

How many copies of the printable W-8BEN form should I complete?

What is the penalty amount for not issuing a W-8BEN IRS Form?

General facts you should know about the W-8BEN tax form

Here you can find information about Form W-8BEN. The form is really helpful for foreign individuals, letting them show they're not from the U.S., which can reduce the taxes taken from their U.S. earnings.

What is W-8BEN form?

W-8BEN tax form is for foreign individuals to prove they’re not U.S. citizens or residents, which helps them get lower tax rates on income from the U.S., like interest and dividends, due to tax treaties. By submitting it, they avoid the standard 30% tax rate and only pay what's necessary. It's important to give this form to the financial institution or agent before getting paid, so the right amount of tax is withheld.

Who needs W-8BEN form 2025?

Form W-8BEN is for foreign individuals who get income from the U.S. and want to pay less tax. If you're earning things like interest or dividends, this form helps you prove you're not a U.S. citizen so you can benefit from lower tax rates. Filling it out means you won't pay more tax than you have to.

When are W-8BEN forms due to the IRS in 2025?

W-8BEN form does not have a specific due date for submission to the IRS, as it is not filed directly with the IRS. Instead, it should be completed and provided to your withholding agent or financial institution before income is paid or allocated to avoid withholding at the 30% rate. The form remains valid for three years unless a change in circumstances occurs, requiring resubmission.

Is IRS Form W-8BEN accompanied by any other documents?

Generally, Form W-8BEN itself doesn't require additional documents to be submitted with it. However, it's important to accurately fill out the form with all the necessary details. Sometimes, a payer or withholding agent might ask for extra information to verify your foreign status or eligibility for tax treaty benefits.

Where do I send W-8BEN form?

You should send Form W-8BEN to the financial institution or the withholding agent who requested it when you receive income from the U.S. Do not send it to the IRS. This is to ensure the correct tax rate is applied to your U.S. income, potentially reducing the amount withheld due to tax treaties.

What payments and purchases are reported in the W-8BEN tax form?

Form W-8BEN is primarily used by foreign individuals to establish their foreign status and claim tax treaty benefits on U.S. source income. The form covers income types such as interest, dividends, rents, royalties, and other fixed or determinable annual or periodical income. It ensures that appropriate withholding tax rates are applied, potentially reducing the default 30% rate for eligible recipients under applicable tax treaties. Additionally, purchases of U.S. real property interests by foreign persons are also reported on the form.

How many copies of the printable W-8BEN form should I complete?

Form W-8BEN should be provided to each withholding agent or payer from whom you receive a payment or have income allocated to you. It is not sent directly to the IRS but instead is held by the payer for verification and reporting purposes. Typically, you need to provide a separate form for each withholding agent or institution requesting certification of your foreign status.

What is the penalty amount for not issuing a W-8BEN IRS Form?

While there's no direct penalty from the IRS for not providing Form W-8BEN, failing to submit it to your withholding agent can result in a default 30% withholding tax on eligible U.S. source income. This is significantly higher than treaty-reduced rates, where applicable. To avoid excessive withholding, individuals should ensure that they submit a valid and complete Form W-8BEN to their payer or withholding agent promptly.

Show more

Show less

FAQ

What is the W-8BEN purpose?

Form W-8BEN is used by foreign individuals to certify their non-U.S. status and claim tax treaty benefits on eligible U.S. source income. It ensures that the correct withholding tax rate is applied, potentially reducing the default 30% rate for those eligible under applicable treaties. This form is essential for foreign individuals receiving income such as interest, dividends, and royalties from U.S. sources.

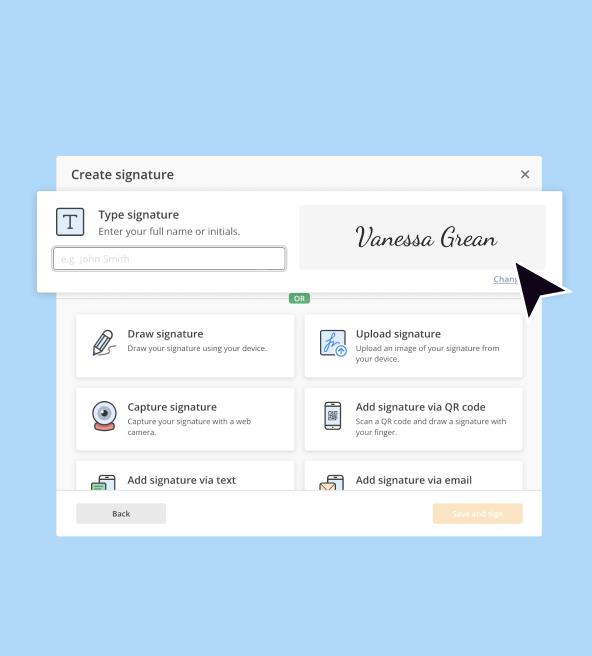

What are the requirements for electronic signatures on Form W-8BEN?

The recent updates allow for electronic signatures on Form W-8BEN, provided they comply with specific regulations under Chapter 3. The electronic signature must indicate authorization, such as a date and time stamp. An electronically signed form must also be accompanied by any additional requested documentation to verify the signature's authenticity.

Are there circumstances where Form W-8BEN is not suitable for use?

Yes, Form W-8BEN is not used by foreign entities, U.S. persons, or foreign intermediaries acting on behalf of others. U.S. persons and those receiving income effectively connected with a U.S. trade or business should use Form W-9 or Form W-8ECI, respectively. Proper form selection is crucial to ensure compliance with IRS withholding requirements and prevent incorrect tax treatment.

How long is Form W-8BEN valid once submitted?

Once submitted, Form W-8BEN generally remains valid for three years, ending on the last day of the third calendar year following the date it was signed. However, if circumstances change that make the submitted information incorrect, a new form must be filed. Continuing to rely on an outdated or incorrect form could result in incorrect tax withholding.

Our user reviews speak for themselves

pdfFiller users experience the benefits of our platform firsthand. Here are just a few examples from satisfied customers.

I am really new at trying this out. The fax feature sounds like it would be very useful to me. I am very interested in learning about all the features offered through this service.

Just what I needed to fill out promptly and neatly PDF applications and forms.

Fill out W-8BEN Form

Forms related to the W-8BEN Form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.